Petty Cash Log for Small Business

Petty cash is a limited amount of cash a business can keep to handle minor and incidental costs. It is usually kept on hand, such as in a lockbox. A small business needs to keep this cash in case it needs it for office supplies, employee reimbursements, small changes, etc.

It is important to keep track of petty cash so that it is known where the money is being used and how much is still available. A petty cash log is helpful here. A small business needs to keep track of all expenses to prosper.

What is a petty cash log for small businesses?

This log records all the transactions connected to the small businesses’ petty cash fund. These may relate to vendor payments, certain reimbursements to employees, and other related financial details. The log includes details related to petty cash.

The log lets a small business owner know when petty cash has been used. It describes the particular transactions and even the amount spent. It will also be known who received the petty cash. Therefore, the log can help with budgeting.

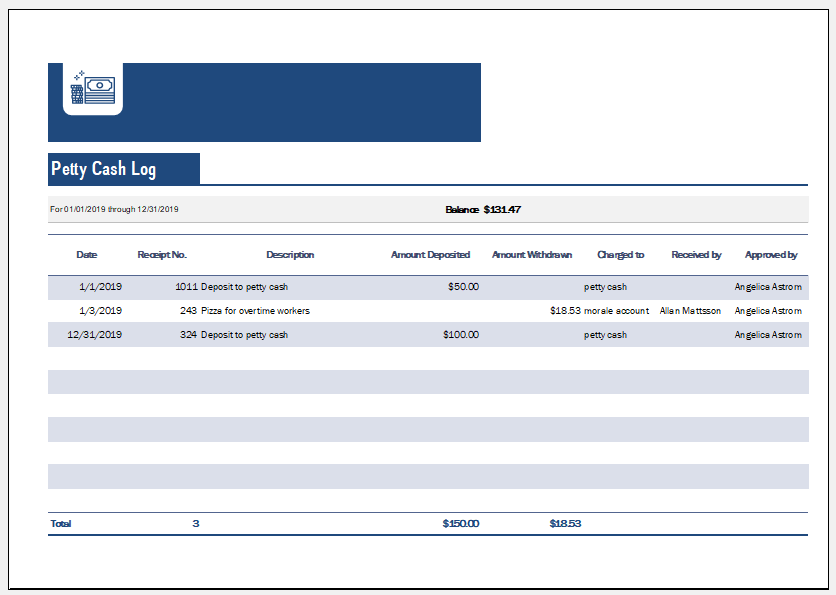

[Sample -1]

Format: MS Excel 2007/+ File Size: 210 KB

A small business wanting to make an accurate petty cash log must record all important details promptly. The following are some tips that you should consider when making this log:

Details to include:

The heading can be “Petty Cash Log”. It is important to include a heading so that you know what the document is about immediately and whether it is the one you need to consult. There needs to be a space where you state the “date from” and “date to” so that the time frame of the log is known. You can have an area for the previous balance as well.

Tabular data is easy to read:

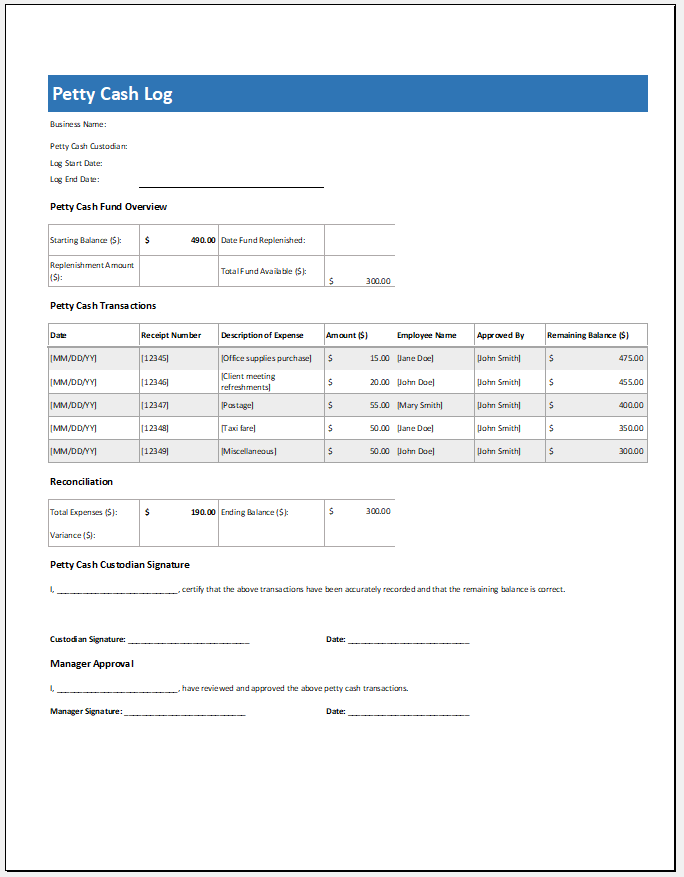

A table format will help you include the necessary information related to petty cash. A column for date will state the date that the petty cash has been used. A column needs to be created for the description. Under this, you will precisely state where the petty cash was used so that this is known. A column for “cash in” and another for “cash out” can be present. There will be a column for balance as well.

At the bottom of the table, there needs to be a column for the total so that the amount of petty cash used and the amount left can be known.

Signature:

An area where the date and signature of the concerned individual are present can be provided so that the document is valid.

Use cash wisely:

A small business needs to know where cash is used to determine how much is being spent and how to adjust this. The business may not have many funds, so it is necessary to use the available funds effectively if the business is to prosper. This is true when looking at petty cash. A proper petty cash log can help a small business out, as it will know where the cash is getting used.

Small businesses can calculate how much is used on small and daily costs such as food, office supplies, travel, electricity, etc. A business needs to record and know about this information so that enough petty cash is present when needed.

A small business owner will know when a limited amount of petty cash is present and when it will need to reserve more for future use.

Preview

Format: MS Excel /File Size: 80 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Sales Lead TrackerNext Article →

Quarterly Sales Report Template