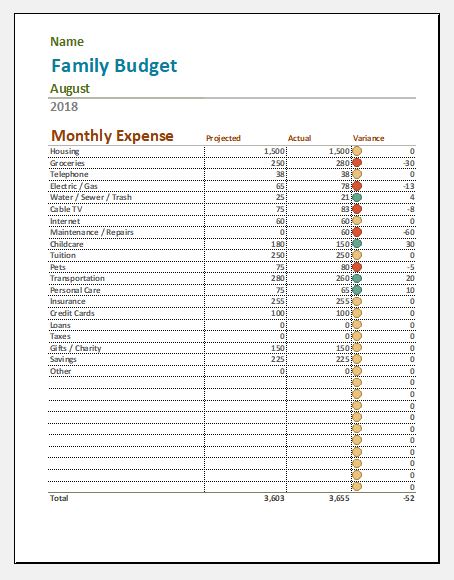

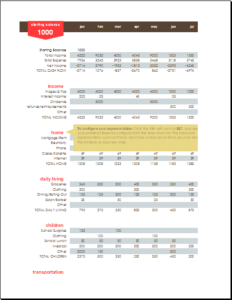

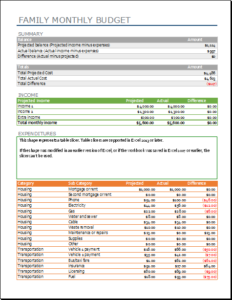

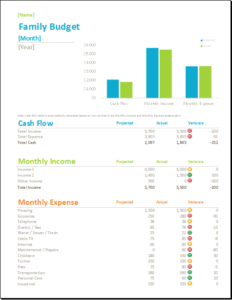

Family Budget Templates

We all are aware of the benefits of creating a budget. A budget is an essential tool which helps us to keep a balance between our income and expenses.

Like any business, the use of a household budget is also gaining popularity. By making and following a proper household budget, a family can track income and expenses of an entire month or even a year. A family budget can be detailed or simple and it varies from one family to another depending on their needs and lifestyle.

Family budget acts like a financial map that helps in achievements. To attain future needs and overcome financial hardships, it is important to know how to make a good budget for the whole month, which is not that difficult.

Following points should be considered while making a household budget:

1: Calculate your spending’s:

It would be advised that all the family members shall sit and calculate the expenses such as mortgage, fees, bills but don’t forget to add up the little purchases such as buying a coffee or a snack.

Points to ponder:

- Keep the utility bills so that you know where you have spent the money.

- Go through statements when a family member uses a debit/credit card.

- Watch your spending habits.

2: Compare your expenses with family income:

Deduct your total expenses (sum of all expenses) from your total income and analyze your results.

3: Aim some financial goals:

This is very important if your family wants to attain some future goals. This increases the motivation. It may vary from one family to other depending upon the needs. It may include:

- New car

- Big home

- Child’s birthday party

- Pay off the mortgage

- Planning a family trip

4: Make your own family budget:

Based on your income, expenses and financial goals, we easily get to know which area needs to be worked on, and which expenses need to be cut down.

How to make a Budget?

You can make a budget in following two ways:

- Book or pen (handwritten)

- Computerized

In today’s era, when money is considered as the most important factor of life budgeting helps us in taking control of our expenses and gives us financial security. Following a proper budget teaches the worth of money to the family members. The family budget gives a sense of responsibility and accountability.

A well-designed family budget helps in organizing the family chores as well. Don’t believe it!! You can try it from your home, we can tell you how;

Decide you Menus in advance:

Not only that it saves money by buying grocery in bulk at one time but also saves the time.

Plan out family gatherings/picnics:

Recreation and enjoyments is a part of life and is an important part of the budget. Dates and total expenses shall be included while preparing a monthly budget.

Paying Off Mortgages:

The mortgage is a liability and needs to be paid off. So add it and pay it on time.

Children’s educational expenses:

Aiding a little amount to it can save you from a financial burden.

Medical expenses:

This is the most important and unforeseen expense and needs to be calculated in advance.

Sample Templates

Format: MS Excel [.xls] | Download

← Previous Article

Fuel Log TemplatesNext Article →

Office Supply Inventory List Template

Leave a Reply