Cash or Funds Donation Receipt

A cash or fund donation receipt is a document that serves as proof that the person has made the payment. A fund donation receipt is also used to acknowledge the contribution of the person to an NGO. When a person makes a payment, the receipt is given to him right away. Some organizations also send an email to inform the donor that funds have been received.

Charitable donations tend to be tax-deductible for the particular donor and reportable by the specific nonprofit organization; therefore, a donation receipt needs to have precise information concerning the exact value of the donation as well as what the donor got in return. It is easy to make a donation receipt by hand as well as on your computer. This article will tell you how to.

You need to first choose the form of the receipt. You can make it in the form of a letter, a postcard, or something that one can fill in by hand. It just needs to have the proper information. It is important to write the name of your particular charity.

You also need to state that you are precisely a non-profit entity. The donor’s name has to be on the receipt. In this way, it becomes valid. You have to write the date of the donation plus how much was given. The donation may not be in cash; if so, write a description of what it was.

It is also important to specify if the donor got something for the donation. This is essential, as only the amount that is higher than the goods or services will be regarded as tax-deductible. More information needs to be included for vehicles that cost more than $500. If you sold the vehicle, then you will have to state that on the receipt, if not, then you will have to state what you are going to use it for. Include a disclosure statement if it is required.

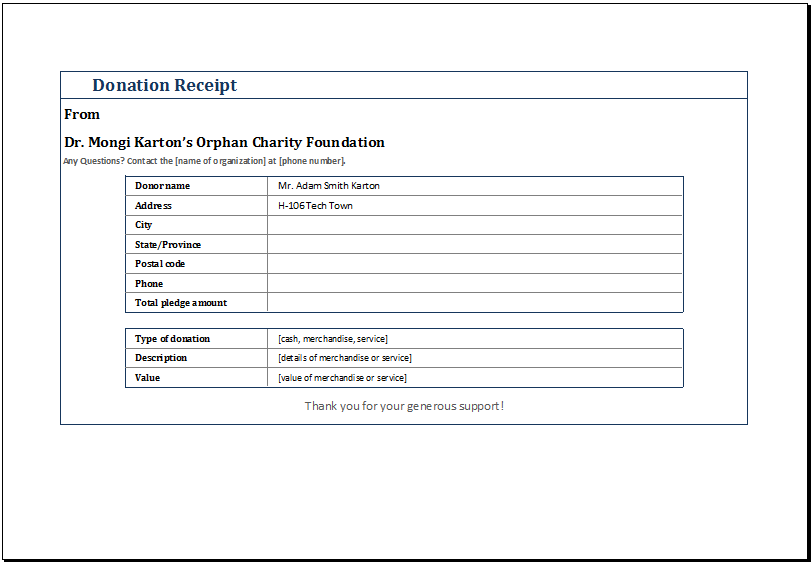

The receipt needs to be signed precisely by someone in the organization. You need to keep a copy of this receipt. You can find donation receipt templates online, including the one given here.

What are the benefits of cash or fund donation receipts?

- The non-profit organizations should send the fund receipt to the donor as soon as possible. These receipts are very beneficial for the donor if he wants to receive tax deductions based on the money he has donated. Donors also need documentation for many other purposes.

- A donor may want to know whether the donation has been received or not. Sending the fund donation receipt helps the donor confirm that the donated money has been received by the organization.

- When a donor wants to keep a record of the financial transactions, he can keep the record of receipts he receives from the non-profit organization.

- Some organizations are also required to submit their fund donation receipt to the IRS. Sending a receipt is important for them since they can face a penalty of $10 or more if they don’t submit the receipt

- The history of donations made by a particular individual or an institute can also be tracked with the help of a fund donation receipt.

- A non-profit organization needs to keep a clear and accurate record of the money it receives. The donation receipt can be used for record-keeping

If you want to have a donation receipt for your company that you can use for different purposes, you can use a sample donation receipt template to assist you in creating your own.

Furthermore, if you want to use the sample receipt, you can download the template, as it is easily printable and downloadable. The user can also customize it according to his needs. Managing the charities becomes easier with the help of a donation receipt.

Preview

Sample View

Download your file below.

File Size: 33 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Cash Deposit TicketsNext Article →

Customer Informaion and Ranking Tool