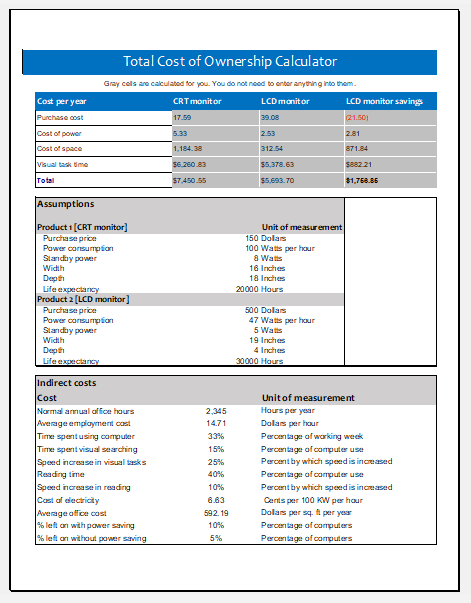

Total Cost of Ownership Calculator Template

Many consumers or business people estimate the total cost of a product, and it doesn’t matter if it is a direct or indirect cost. The results obtained from the estimate are known as the total cost of ownership. In this process, the total value of the asset is determined. It not only includes the purchase value but also the implementation cost.

If you own a certain type of asset, you can calculate all the costs that the assets received. This is called Total Cost of Ownership (TCO), also known as life-cycle cost analysis. Ownership cost includes the initial purchase cost, but it also encompasses the substantial associated cost of installing, using, upgrading, or handling the asset.

TCO analysis is used to sustain the attainment and scheduling of resolutions for assets that involve momentous functional costs during their whole ownership life. Total cost of ownership (TCO) analysis is the key to making the managerial decision to acquire computing structures, buildings, vehicles, surgical equipment factory machines, and expensive aircraft.

TCO analysis needs the following consideration

- Accounting and scheduling

- Management of asset life

- Ranking investment attainment offers

- Retailer choice

File: Excel (.xlsx) 2007/10

Size 20 KB

To calculate the total cost analysis accurately, download the free template with fully customizable options. The template calculates the figures accurately. Fill in your figures and get your instant result.

What is the total cost of the ownership calculator?

It is a tool used to accurately and precisely calculate the total cost of ownership.

What is the purpose of using the ownership calculator?

The main objective of this calculator is to determine the difference between the product’s long-term cost and its price.

Who uses the ownership calculator?

People who purchase a property are usually interested in determining the total cost of ownership. This calculator is used when a person wants to know whether the assets he purchased are overpriced. Company managers, industrialists, and other related people use this calculator.

The total cost analysis is slightly confused with the purchased price, but this lifetime analysis completely differs from the purchase price. This is not a single price; it is a total of the different costs applied promptly to the purchased asset. It could be understood by the example of expensive computer software system organizations. Competitors of such software houses debate that the ownership of a computing system hardware or software has been quite high for the past few years compared to the original purchase price of those computing devices.

Benefits:

- As we all know, assets’ values depreciate over time. This calculator allows us to easily determine the depreciation that an asset has experienced.

- The total cost of the ownership calculator can also help evaluate its total cost and assess the assets’ obvious cost.

- These calculators are very effective in reducing the need for investors to invest money in large capital expenditures.

- TCO calculators empower people to invest in any business according to their capacity. Moreover, the calculator also ensures that the investment is made only when it is highly needed.

- To save costs, the total cost of ownership calculator can be used. The executive presentation can be prepared with the cost-related results.

- One of the best features of these calculators is that the user can easily modify the assumptions by considering a business’s specific needs.

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

← Previous Article

Food Inventory TemplateNext Article →

Personal Collection Inventory Template