Retirement Checklist Template

According to research, the average age at which everyone plans to retire is generally between 65 and 67. Deciding on retirement is not easy.

What is a retirement checklist?

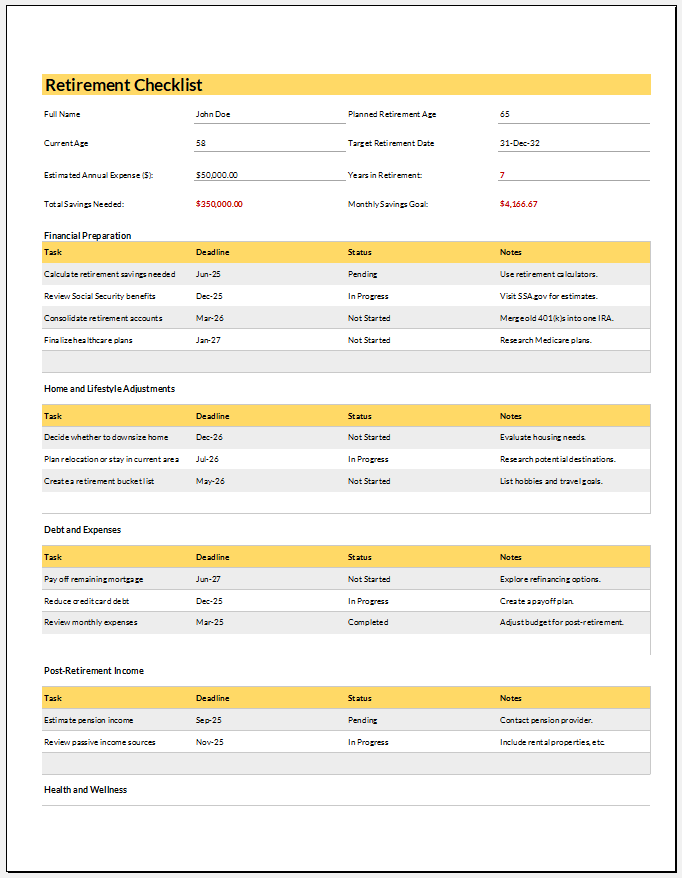

A retirement checklist is helpful if you are thinking about what to plan before you actually retire. Nobody wants to retire from a job with a financial crisis, and planning everything ahead of time can help you avoid one.

Excel (.xlsx) File -102 KB

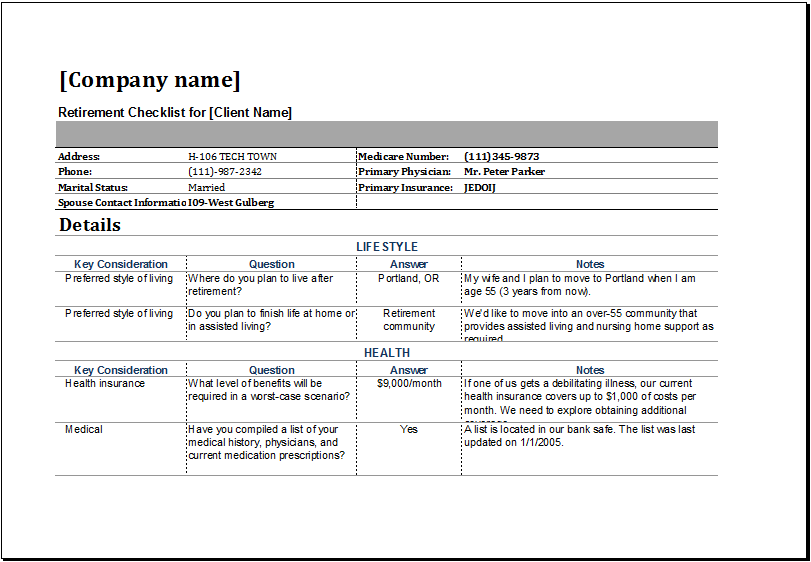

The retirement plan includes setting real-life objectives, starting a business, writing a narration, travelling, or doing social work. Only a few retirees accomplish any fruitful task. The foremost consideration is a residence. The employers may provide some accommodations, so you have to leave them. If you are living in a big mansion, think about whether you can maintain your lifestyle after retirement.

You must check your financial standings, including pensions, accounts, and provident funds, to see if your retirement is near. You should know about the loans you owe. You must plan something that, from your reserves, can generate a flowing income that might be of lower value. Still, a continuous income is inevitable for a comfortable lifestyle. Look out for the social security provision and to what percentage you are eligible. Consider how you’ll handle un-disputable expenses in retirement, such as illness or repairs.

It would be better to have a health check and update your health insurance. Though it sounds bad, it is better to Prepare or revise your will. For such purposes, establish a power of attorney and an advance health edict to avoid future glitches.

The checklist mentioned above serves the retiree or the to–be a retiree to set up a retirement plan. This will benefit in leading a convenient lifestyle. To prepare the checklist, you can use free templates for retirement checklists downloaded from websites. Customize this checklist according to your needs and get a printout.

What are the benefits of a retirement checklist?

The benefits one can avail of by using this tool vary from person to person. These benefits usually depend on your job, circumstances, employer preferences, etc. However, there are some common benefits, which are:

Every person should understand how financially stable he is before retiring. You should consider your income, income statement, balance, and insurance policy for this. The retirement checklist enables the person to assess his account balance before retirement to live comfortably.

Another thing that a retirement checklist diverts your attention towards is debt. A person should never retire with the burden of debt on his shoulders. He should accept the fact that he is not going to receive a paycheck after retirement. Paying off the debt with the pension will be very hard. So, the checklist reminds the user to get rid of all debts before retirement.

The retirement checklist also enables the user to determine his needs after retirement. He can then manage everything accordingly to fulfil all his needs.

Key features of the retirement checklist template:

The retirement checklist template is available for free download. This template contains all the tasks that a person must do to make an effective retirement plan. Anyone who wants to use the retirement plan should remember that the checklist should be used at least four years before retirement since sometimes the planning gets a little complex, making everything time-consuming.

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Loan Calculator TemplatesNext Article →

Services Price List Templates

Leave a Reply