Loan Calculator Templates

Many people take out loans when trying to make a big purchase like a car, house, or property or when about to start up a business. These loans are spread out in plans that require the individual to pay a certain amount every month along with the interest amount. Individuals who seek out loans need to think a lot about how they will be paying off the loan since the interest amount added makes the whole amount higher than the original price.

What is a loan calculator?

A loan calculator is an effective and handy tool that enables the user to determine the monthly payments required to pay off the loan. By efficiently using the loan calculator, the borrower learns the total amount he must repay. The loan calculator also helps the user determine the interest he will have to pay.

What is the basic purpose of using the loan calculator?

A loan is a burden that everyone wants to get rid of. Some people are given the flexibility to pay the loan in multiple small or big instalments. The interest rate also accompanies the repayment of the loan as an instalment.

The borrower should be aware of the interest he is paying and the repayment of the borrowed money. Moreover, people who want to know how long it will take to pay off the borrowed money with their chosen interest rate and instalment amount can also use a loan calculator.

To calculate how much money one has to pay back on a monthly or yearly basis, one can use the Loan Calculator. This calculator helps an individual calculate the monthly or annual amount to be paid.

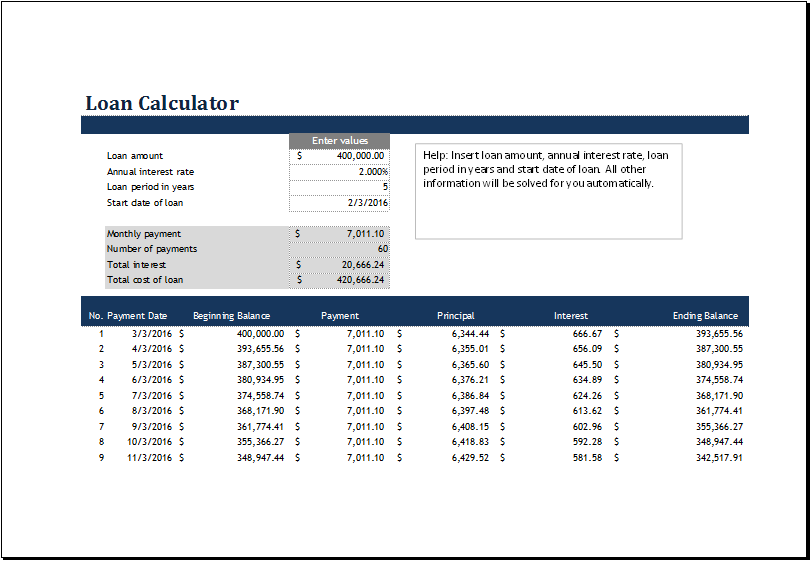

This calculator can be found online on various websites or download the application on your cell phone or tablet. All it requires you to do is fill in the loan amount along with the years or the months that the loan is expected to be paid off and the interest rate (if you are unsure about the interest rate, you can always check the get today’s interest rate option – It may differ country to country) and the date on which the loan started. It will calculate how much money you need to pay monthly, along with a chart showing how small the principal amount is and how the interest is paid.

Using a loan calculator can help individuals decide whether a specific loan package works for them or if the loan is affordable.

What are the advantages of using the loan calculator?

People who want to return borrowed money as soon as possible should use a loan calculator because of its many benefits. Here are a few widespread benefits of using a loan calculator.

- The loan calculator clearly shows the payments the borrower will have to make to pay off the debt. This allows the person to determine whether to borrow the money or not, saving himself from the strict loan repayment instalments.

- The loan calculator gives accurate results, so the user can quickly determine the difference between the actual and estimated amounts.

- The loan calculator is also helpful for students or retired people who are given special discounts.

The loan calculator template provides formulas that quickly calculate everything related to loans. This saves the user time and also saves him from the hassle of calculating everything manually.

Simple Loan Calculator

Download your file below. File Size: 128 KB.

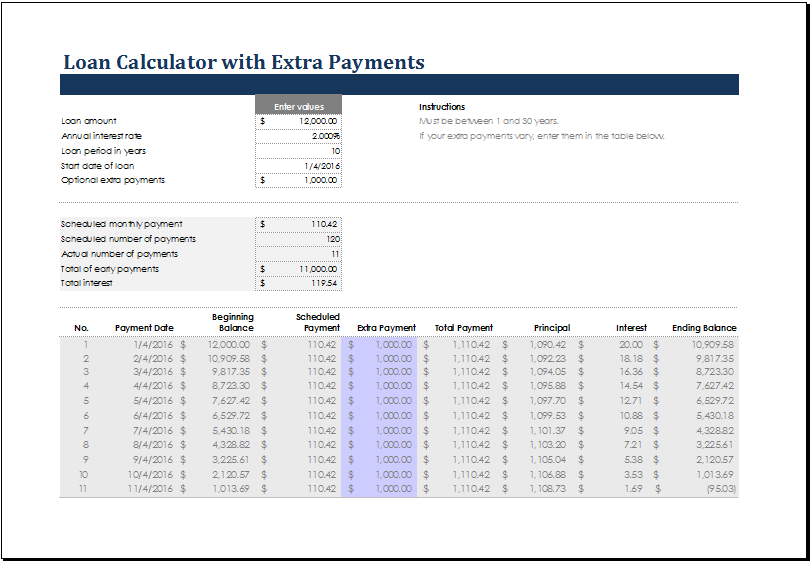

Loan Calculator with Extra Payment

File Size: 139 KB

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

← Previous Article

Education Credits TrackerNext Article →

Retirement Checklist Template

Leave a Reply